Real-time monitoring of crops

With our unique digital platform, we closely monitor the state of the crops.

24/7 monitoring of fields by satellite images

Swift determination of extent of damage

No visit from loss adjuster required

Second opinion possible on site

Quick response

Smooth claims settlement & payment

Our experts rely on data, statistics, local sampling and satellite images. In case of damage, we take immediate action.

When damage occurs early in the season, a replanting indemnity is paid which allows the farmer to replant immediately.

For damage occurring later in the season, we base payouts on data and statistics.

A second opinion from an on-site expert can clarify the matter in case of doubt.

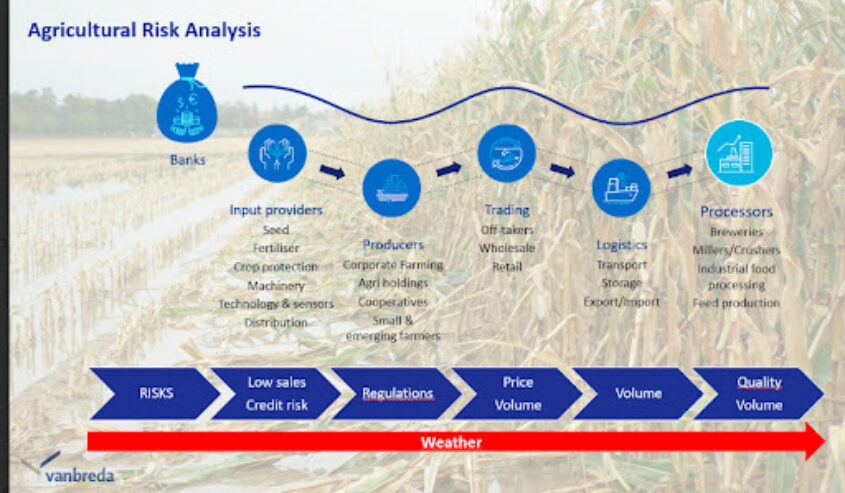

Customised insurance solution

Our experts know all the available insurance solutions on the market. They discuss with you the risks to your business and identify them in a clear way. The result is a tailor-made insurance solution.

Specialised insurance brokers in the agricultural sector

Our specialists always look for the most comprehensive covers. Our solid international network guarantees us expertise abroad at the local level. This also makes Vanbreda the perfect partner for multinational companies.

Conditions at the most competitive premiums

Thanks to our extensive client portfolio and our strong market position, we obtain conditions at the most competitive premiums.