A commuting accident is one that happens to an employee on his or her normal route to or from work. It doesn’t matter what means of transport (car, public transport, bicycle, e-scooter, walking) is used. The legally required work accident insurance policy covers the physical harm that your employee suffers.

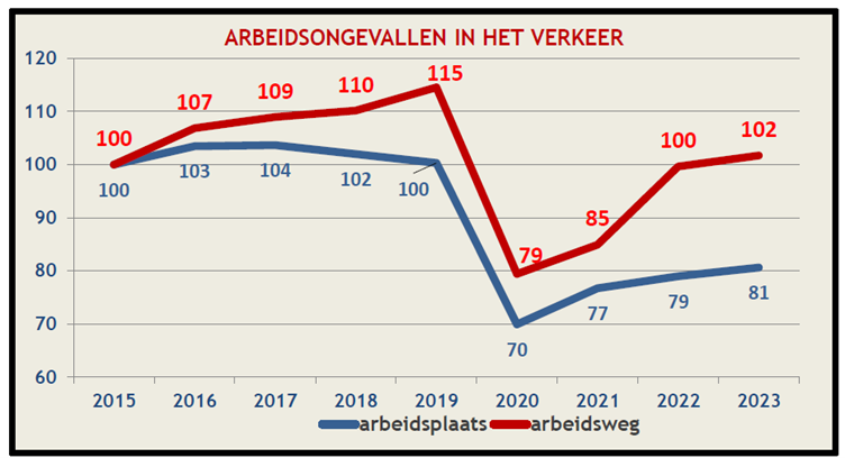

The rise in the number of commuting accidents is clearly visible in the statistics of recent years. These figures show how your employees’ mobility directly affects your business.

- During the Covid period (around March 2020 – early 2022): more people were working from home, so there were fewer work accidents.

- After the Covid period (from around early 2022 – present): the number of work accidents held steady at a lower level than before Covid; however, commuting accidents have begun to consistently increase again in recent years as more journeys are made between home and work.

The future of mobility is clear: bicycles and e-scooters remain extremely popular. Many employees have discovered their advantages (flexibility, cost savings, health and environmental benefits) and continue to use these means of transport.

- Bicycle allowance and infrastructure: Since 1 May 2023, the bicycle allowance has been mandatory for all employers, giving this form of mobility a further boost. The expansion of cycle highways and the popularity of bicycle leasing through employers have also been factors.

- Increase in commuting accidents: This combination of factors has led to a clear increase in the number of commuting accidents involving cyclists and e-scooter users. Relatively speaking, the number of commuting accidents is rising more steeply than the number of accidents at work.

- The rise of e-scooters: A striking increase has been seen in commuting accident statistics in recent years (2017 – 2023) that mention the word ‘scooter’. This is a clear indication that the popularity of this means of transport is surging. The number of commuting accidents mentioning the word ‘bicycle’ remains relatively stable, with a slight dip during the Covid years 2020 and 2021.

Your commuting accident cover usually accounts for a substantial (if not the largest) proportion of your insurance premiums. Recent trends have had a direct impact on this:

- Frequency: More accidents inevitably lead to more claims being submitted to your insurer. The number of bicycle accidents involving injuries is clearly on the rise, while the curve for other means of transport is flattening out.

- Severity: Depending on the circumstances (speed, fall, whether a helmet is worn, collision with a heavier vehicle), accidents involving cyclists and e-scooters can cause serious injuries (such as head injuries or fractures). This means higher medical costs and longer periods of work incapacity, increasing the cost per claim.

- Premium impact and the ‘Covid paradox’: Insurers are monitoring these trends closely. A persistent increase in the frequency and/or average cost of commuting accidents may ultimately lead to adjustments to premium calculations, so good claims figures are as crucial as ever!

At the moment, the positive Covid years (’20 and ’21, when there were fewer accidents) are still included in the five-year statistics that your insurer uses. But beware: these ‘good’ years will soon disappear from the figures. This could result in a significant increase in your claims numbers, and therefore potentially in your premium.

Although you don’t have direct control over what happens on the road, you can certainly help ensure safer mobility for your employees:

Encourage awareness and safe choices:

- Tell your employees about the risks and the importance of safe behaviour (wearing a helmet, visibility, obeying traffic rules etc.), for example via intranet, posters or workshops.

- Actively include safety in your mobility plan and when you promote your ‘cafeteria plan’.

Provide preventive measures and facilities:

- Consider providing bicycle helmets or fluorescent vests.

- Organise obligatory or optional training courses on safe cycling or defensive driving in the city.

Report correctly and on time:

- Make sure that every commuting accident is reported quickly and correctly. If a claim is submitted late, it may be rejected by the insurer!

This trend is certainly not inevitable. We see it with our clients: businesses with alert management and a well-developed health and safety policy supported by forward-looking management and implemented by properly informed employees record fewer incidents, even in an urban setting. It is therefore definitely worth working constructively with your insurance partner.