When an employer takes out a supplementary pension plan for its employees, the employer has a legal obligation to guarantee a 1.75% return on each deposit. However, that guaranteed return is a challenge in the current economic climate. Many insurance formulas - especially Branch 21 insurance policies - that contain the deposits for the supplementary pension have not been yielding 1.75% returns for some time. And so there is a discrepancy between what an employer is required by law to give as a return and the return he receives from the insurer. This discrepancy is referred to in professional jargon as “the underfunding”, and has the consequence of potentially presenting an employer with an additional cost.

We are therefore seeing a clear movement in the market with more and more employers abandoning the low fixed returns of a Branch 21 and investing in a Branch 23 formula with a variable return or changing over to pension funds. By opting for variable return pension products, employers are aiming for higher returns and a potentially lower risk of underfunding. The key here is to formulate the plans in such a way that investment risks are adequately spread.

The often strong focus on potential underfunding in a group insurance plan could lead to group insurance being considered an unattractive employee benefit. But that’s not true. A supplementary pension plan remains one of the most ideal forms of alternative remuneration. With the same budget, you as an employer can offer your employees a higher net benefit.

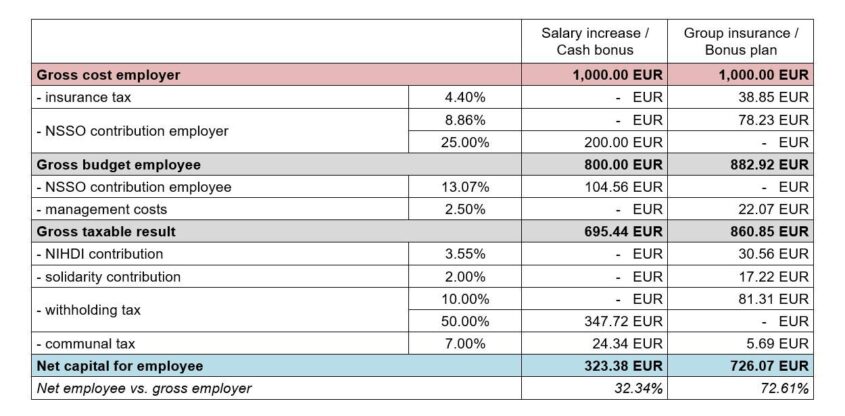

You will immediately notice this in the simulation below comparing the net benefit of a 1,000 euro salary increase with the same premium for a group insurance policy. With a salary increase, the employee receives only 32% of the total salary cost net, while with a group insurance plan it comes to almost 73%. Even though group insurance plans have been giving low returns for several years now, it remains difficult for the employee to close this gap with the returns from a private investment or investment in real estate, for example.

The advantage that group insurance offers today is dampened by the fact that as an employer you are required to offer a mandatory return. That’s correct. Due to current market conditions, returns - especially in a Branch 21 formula - are not always achieved. But even though the returns are low, the difference made up by the employer is still more than worth the investment when we consider the net benefit that employees gain from it.

The guaranteed return presents a challenge, but a far-sighted employer will in due course take stock of the potential underfunding and, where appropriate, seriously consider Branch 23 insurance or a pension fund that often yields attractive variable returns.

Besides this financial aspect, it should be remembered that the statutory pension needs to be substantially supplemented in order for a worker to maintain a decent standard of living after retirement. The Belgian statutory pension is not expected to rise significantly.

By offering a supplementary pension, you as an employer are able to safeguard your employees’ post-retirement purchasing power. If you keep in mind that the ‘caring employer’ principle is gaining traction in the compensation strategy and a sound retention policy is high on the HR agenda in the current war for talent, the supplementary pension plan is well worth the effort. Even if returns are low.