Who is considered to be a director?

As a director, you’re responsible for the ins and outs of the company. Your tasks are twofold:

- You are responsible for the company’s correct management and are therefore involved in the internal decision-making procedures.

- You are the company’s representative, which means that you have external responsibilities.

As a director, you can be held personally liable for any error or negligence in the performance of management tasks.

The risk of being held liable doesn’t just apply to officially appointed management bodies such as the members of the board of directors or the executive board: de facto directors, who have no formal mandate but nevertheless act as directors in practice, can also be held liable in the same way.

As a director, you need to be aware of the potential risks and how you can protect yourself against them, to avoid any nasty surprises.

What is a director liable for?

Directors can be held liable for various things, including:

- a simple management error

(such as failing to challenge an invoice);

- breaches of the law or the articles of association (such as late submission of the annual financial statements);

- unlawful acts under ordinary law (such as misappropriation of company assets);

- criminal offences (such as violations of social, tax or environmental law);

- actions constituting special grounds for liability, such as wrongful trading.

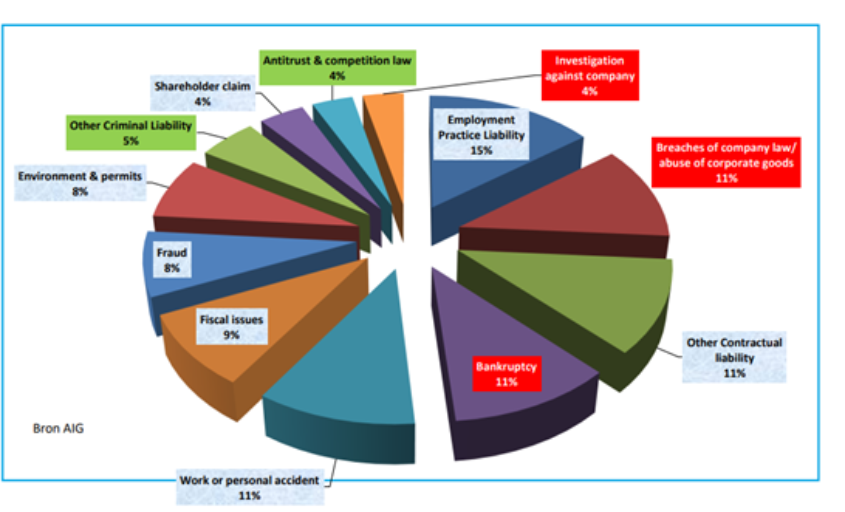

In practice, directors are often held to account for errors in connection with a bankruptcy, violations of employee rights (such as sexual discrimination or wrongful dismissal) or infringements of company law.

Who can hold a director liable?

Directors can be held liable by both the company and third parties. With the introduction of Book 6 of the Civil Code (covering non-contractual liability law), from 1 January 2025 directors can also be held directly liable by the company’s contractual partners. In principle, this used to be impossible. This change in the law therefore significantly increases the liability risk for directors.

In practice, most liability claims against directors are brought by the company itself (actio mandati), shareholders and employees, as well as by the government, mainly in criminal cases.

What happens in the event of an error?

Since you hold significant responsibility as a director of a company, you are at considerable risk of being held liable. Fortunately, there are a number of measures you can take to protect yourself against these liability risks. Here is an overview:

- Arrange suitable directors’ liability insurance: it’s becoming increasingly important to take out insurance that covers directors’ liability, also known as D&O insurance. Areas covered by insurance of this type include:

- Legal defence costs: disputes about directors’ liability are often both complex and extremely costly. We know from experience that directors’ liability policies provide an important buffer for defence costs, which can really mount up.

- Compensation: this relates to the financial damage resulting from a management error.

D&O insurance is taken out by the company in which the directorship is held. The types of cover and the maximum amounts must be looked at on a case-by-case basis.

- Screen your contracts and build in contractual protection

Alongside the protection offered by insurance, you should also think about contractual protection and build it in as much as possible. Your liability can often be limited or even excluded by means of clauses in a contract.

This can be done in the director’s contract (the contract between the company and the director), in the agreements between the company and its customers and suppliers, and in the company’s general terms and conditions.

Other protection mechanisms

There are a number of other protection mechanisms that are definitely worth mentioning:

- Legal protection: the law also offers directors some protection by limiting liability. For example, the Companies and Associations Code (CAC) includes a 'CAP' on such liability. Also, under the CAC directors can only be held liable if their actions clearly lie beyond the limits of those of a normally prudent director.

- Alertness in your management role: you can ask to resign from your position or seek a discharge from liability from the general meeting. If you find yourself disagreeing with a particular decision, make sure that your objection is recorded and that the error is reported to the company’s collective management. This will prevent you from being held liable later on. Given that directors are in principle jointly and severally liable, meaning that in most cases a claim can be made against all directors, they need to be doubly alert in this regard.

- Prevention: it’s also vital to consider preventive measures to limit your liability as a director. Embrace risk management, implement clear procedures within the company to prevent errors and keep your knowledge of directors’ liability up to date, to name but a few.

Services provided by Vanbreda Risk & Benefits

With ever-increasing exposure for directors, D&O insurance definitely isn’t a superfluous luxury these days. Such a policy is underwritten entirely according to the nature of the company. As a specialised insurance broker, Vanbreda Risk & Benefits keeps close track of developments in order to provide you as a director with the most comprehensive, but also the most competitive solution. For more information, contact Anouk Dehing: anouk.dehing@vanbreda.be