A bonus pension plan is a way of awarding variable pay to employees that’s advantageous in terms of taxes and other levies. It is a group insurance plan in which the pension accrued by the affiliated employees depends on them achieving the targets set by the company. This means that you can reward your employees’ efforts with additional pension growth.

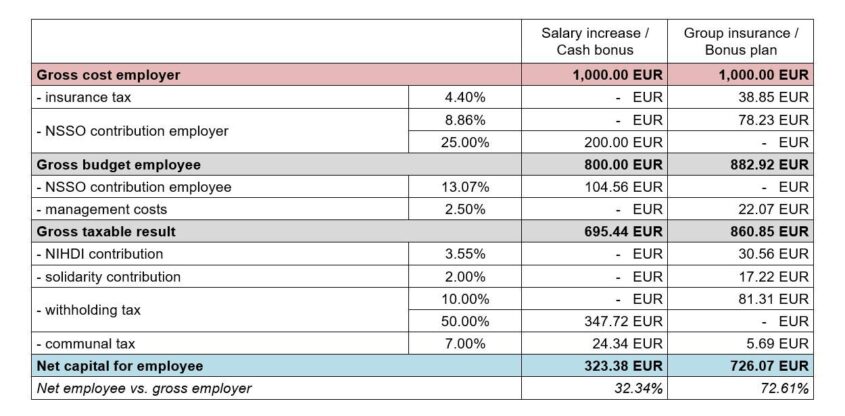

A bonus pension plan is advantageous for both employer and employee in terms of taxes and other levies. This is clear in the simulation below, where the net advantage of a cash bonus of EUR 1,000 is compared with the same sum spent on group insurance.

If you pay a cash bonus, the employee receives a net amount of just 32% of the total salary cost; with group insurance the employee receives 73%.

In addition, employees can finance a real estate project by taking out a cash advance on the capital accumulated in the bonus pension plan. In an upcoming article we will look in more detail at the conditions for taking an advance and the tax effects of this when the pension is paid out.

If you want to increase your employees’ pension growth by awarding a bonus pension, you should take the following points into account:

- Who will be affiliated to the bonus pension plan? As an employer, you determine the affiliation conditions for the plan. These conditions must comply with the anti-discrimination provisions of the Law on Supplementary Pensions. For example, no new distinction can now be made between manual and white-collar workers, and affiliation cannot depend on a further decision by the employer.

- The bonus pension plan will apply to all employees who meet the affiliation conditions. Only employees already working for your company when the plan is introduced can refuse to join it. This refusal applies for the plan’s entire duration. Employees who join the company after the plan’s introduction and who meet the affiliation conditions will automatically join the plan: they cannot refuse to do so.

- The anti-discrimination provisions of the Law on Supplementary Pensions also apply to the targets that are set for receiving the bonus. These can be both individual and collective targets, so long as they are objective and measurable.

- Pay close attention to the wording of your internal bonus rules. This will help you to avoid the plan being reclassified for social security purposes.

- Get started in good time. Would you like to be able to pay a bonus into the group insurance plan next year relating to the targets set for this year? If so, you need to start the bonus pension plan before the end of the year.

Do you have further questions about bonus pension plans or the points you need to consider when introducing such a plan in your company? If so, contact your regular Employee Benefits Account Manager immediately.